42 coupon rate bond formula

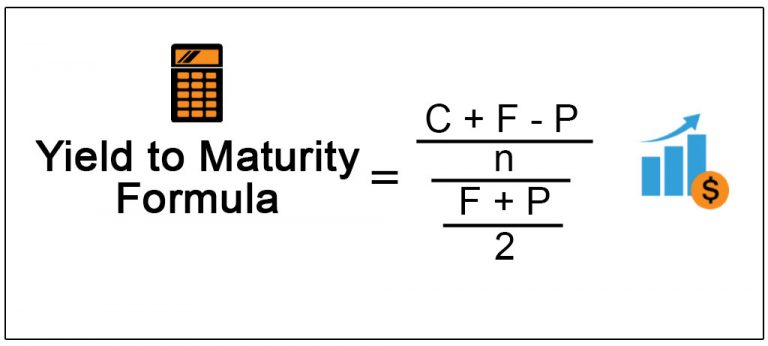

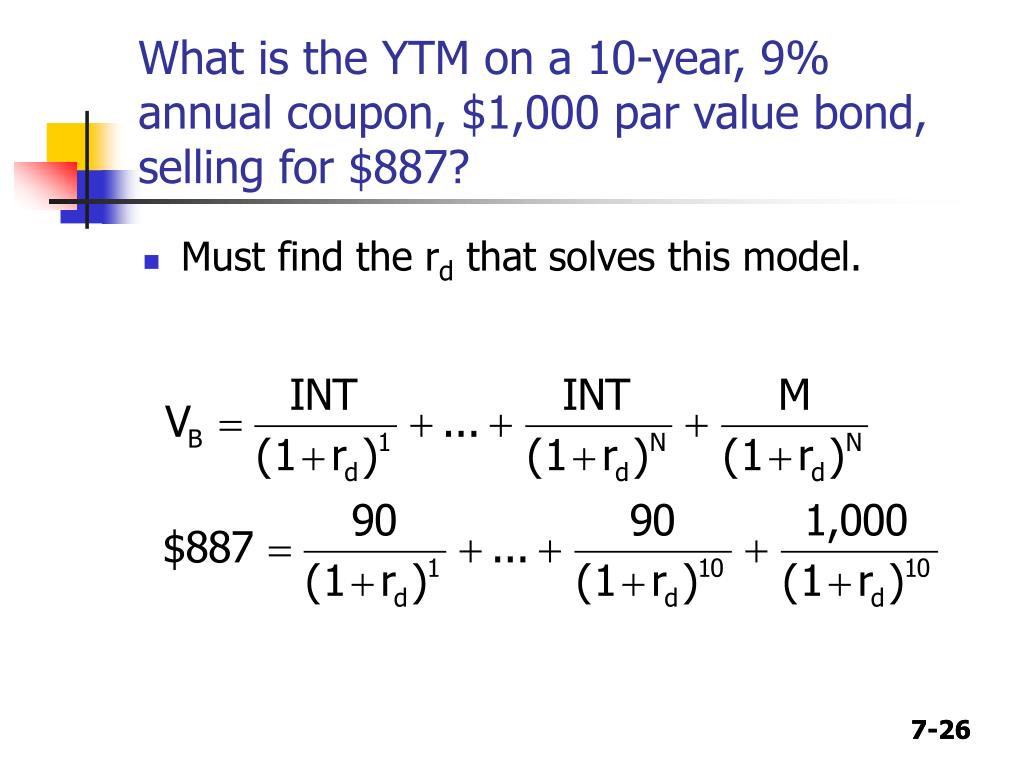

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, You are free to us...

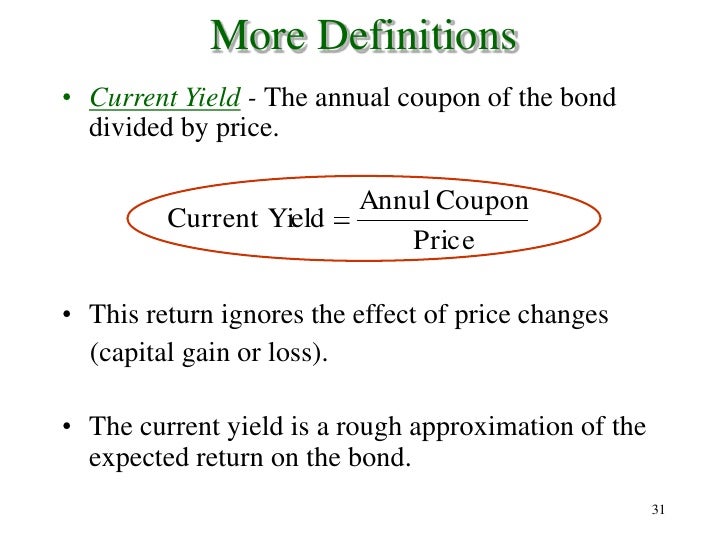

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Coupon rate bond formula

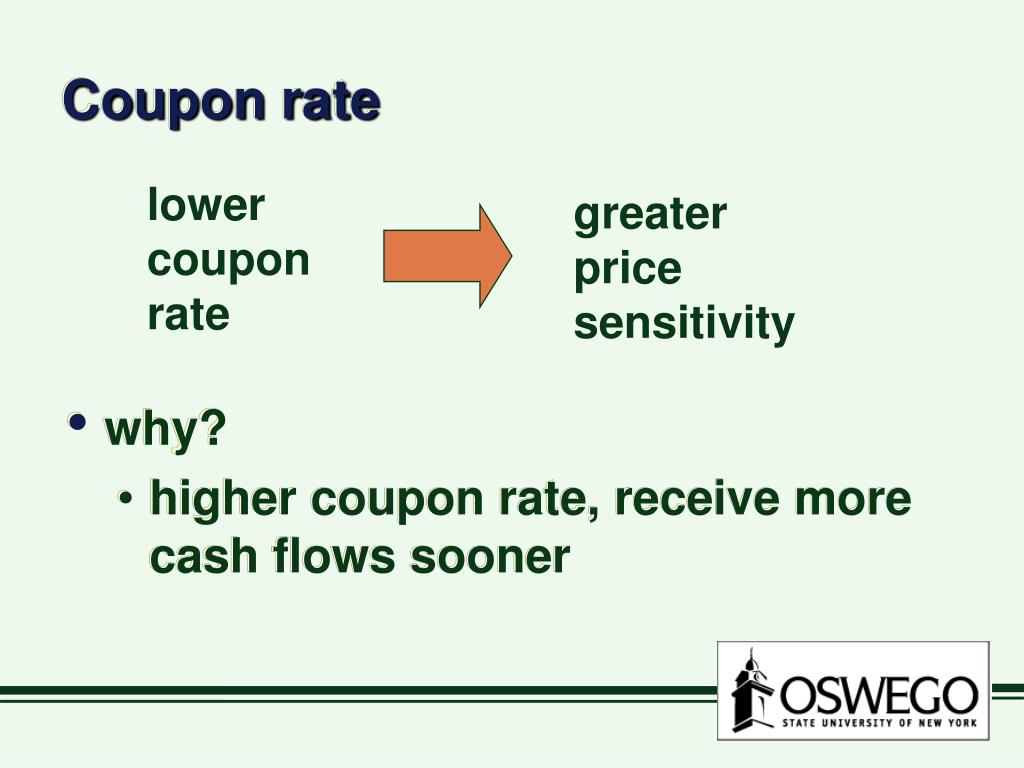

Coupon Bond Formula | Examples with Excel Template The formula for coupon bond can be derived by using the following steps: Step 1:Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2:Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate of a bond is determined after considering various factors, but two of the key factors are interest rates of different fixed income security available in market at the time of issue of bond and creditworthiness of the company. The coupon rate of a bond is determined in a manner so that it remains competitive with other available fixed in...

Coupon rate bond formula. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate of a bond is determined after considering various factors, but two of the key factors are interest rates of different fixed income security available in market at the time of issue of bond and creditworthiness of the company. The coupon rate of a bond is determined in a manner so that it remains competitive with other available fixed in... Coupon Bond Formula | Examples with Excel Template The formula for coupon bond can be derived by using the following steps: Step 1:Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2:Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment...

Post a Comment for "42 coupon rate bond formula"