44 coupon rate treasury bond

TVA Bonds: U.S. Government Credit Rating At Over 4% Yield To Maturity They mature in 2028 and 2029 and are rated the same as U.S. Treasury notes but currently have a yield to maturity over 1% above Treasuries. The coupon would reset lower in the unlikely event 30 ... Should You Buy Treasuries? With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison,...

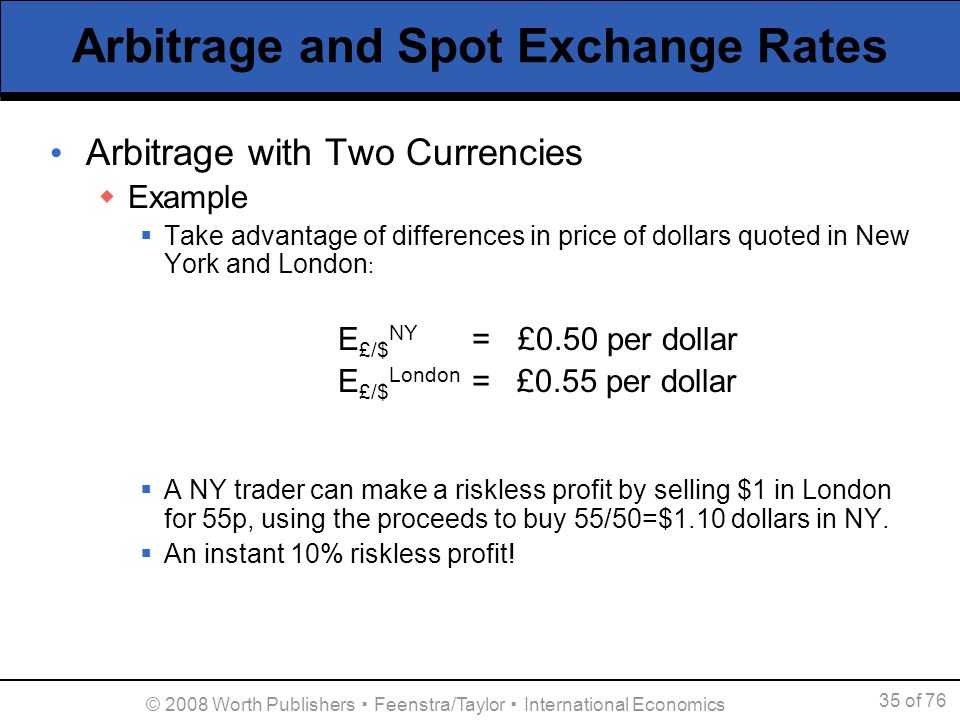

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon rate treasury bond

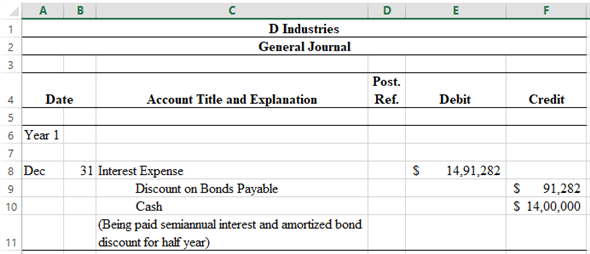

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-07-15 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant ... Quarterly Refunding Statement of Deputy Assistant Secretary for Federal ... WASHINGTON — The U.S. Department of the Treasury is offering $103 billion of Treasury securities to refund approximately $47.8 billion of privately-held Treasury notes maturing on May 15, 2022. This issuance will raise new cash of approximately $55.2 billion. The securities are: - A 3-year note in the amount of $45 billion, maturing May 15, 2025; - A 10-year note in the amount of $36 billion ...

Coupon rate treasury bond. Government to pay 29.8% interest rate on 3-year bond Meanwhile, government secured $81.23 million from the 5-year domestic denominated Treasury bond due November 2026. This debt instrument was via a tap issue. The coupon rate was 6%, lower than the... Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link Refreshed 2 days ago, on 22 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities. Treasury Bonds: Are They a Good Retirement Investment? The high yield, or auction rate, is 3.18%, so these bonds will sell at a discount to par. 20-year Treasury bills issued on May 31, 2022 have a coupon rate of $2.50% and a high yield of 3.29%, so these bonds will also sell at a discount to par. Can You Make Money on Treasury Bonds? Treasury bonds earn a fixed rate of interest.

Treasury Bonds | CBK Treasury Bonds Rediscounting Calculator This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. Treasury/ Infrastructure Bonds Pricing Calculator Conventional Bonds and Bonds Re-opened on exact interest payment dates Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market. Fixing of coupon rates - Nykredit Realkredit A/S Fixing of coupon rates effective from 29 July 2022 Effective from 29 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly... U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

U.S. Treasury Bond Futures Quotes - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on ... What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.807% yield. 10 Years vs 2 Years bond spread is -21.1 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Treasury Bond Definition, Types, How to Invest - Insider Treasury bonds. $100. Discount, coupon, or premium. ... Interest rate risks: As are all bonds, Treasury bonds are subject to price volatility as a result of changes in market interest rates.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.367% yield. 10 Years vs 2 Years bond spread is 85.6 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.28%, compared to 3.23% the previous market day and 1.85% last year. This is lower than the long term average of 4.37%. Report.

Treasury Announces New Steps to Increase Affordable Housing Supply and ... Treasury releases guidance updates and how-to guide to increase investments in affordable housing using American Rescue Plan funds WASHINGTON - The U.S. Department of the Treasury announced new guidance today to increase the ability of state, local, and tribal governments to use American Rescue Plan (ARP) funds to boost the supply of affordable housing in their communities. This step follows ...

![Basics of Bond Investing [Infographic]](https://www.investologic.in/wp-content/uploads/2014/08/Bond-Investing-900x1436.jpg)

Post a Comment for "44 coupon rate treasury bond"