40 difference between coupon rate and market rate

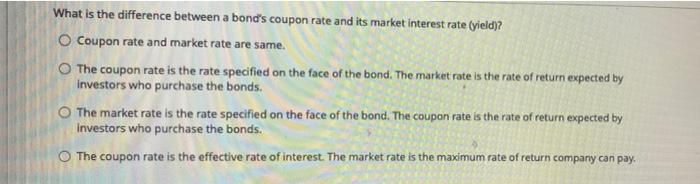

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia 22.3.2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

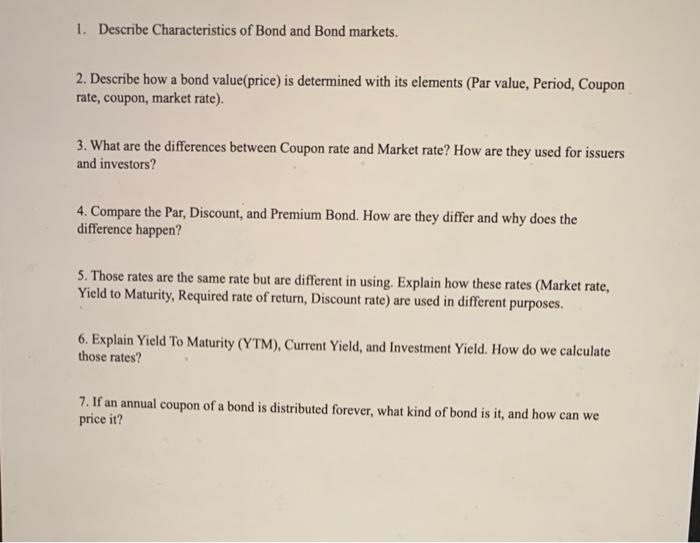

Difference between coupon rate and market rate

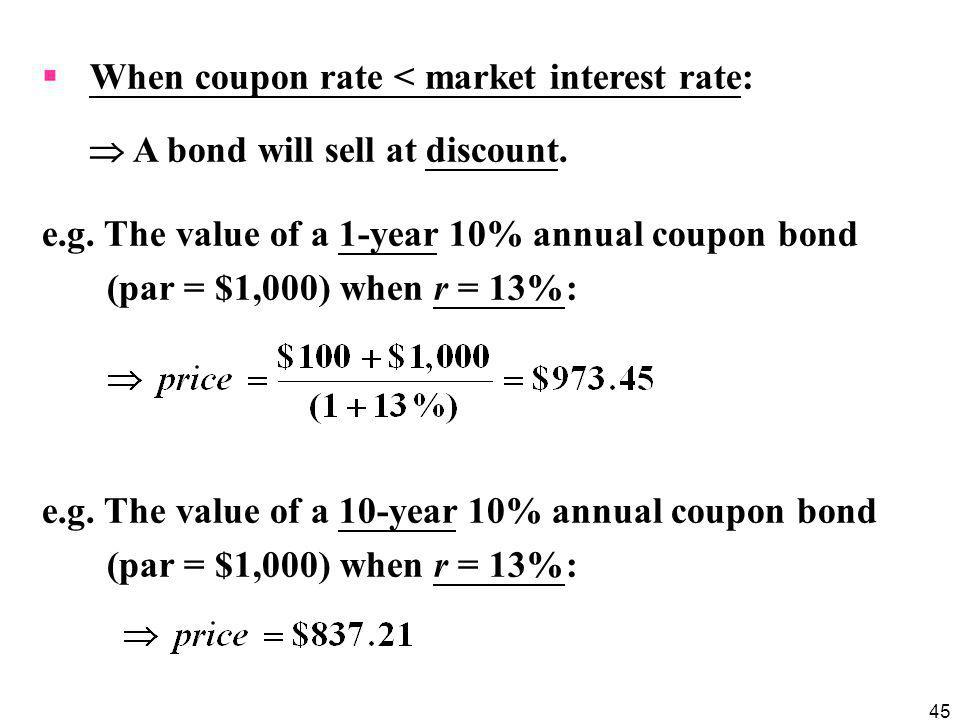

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia In general, a bond's coupon rate will be comparable with prevailing interest rates when it is first issued. A bond's yield, or coupon rate, is computed by dividing its coupon payment by its... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · Find out why the difference between the coupon interest rate on a bond and prevailing market interest rates has a large impact on how bonds are priced.

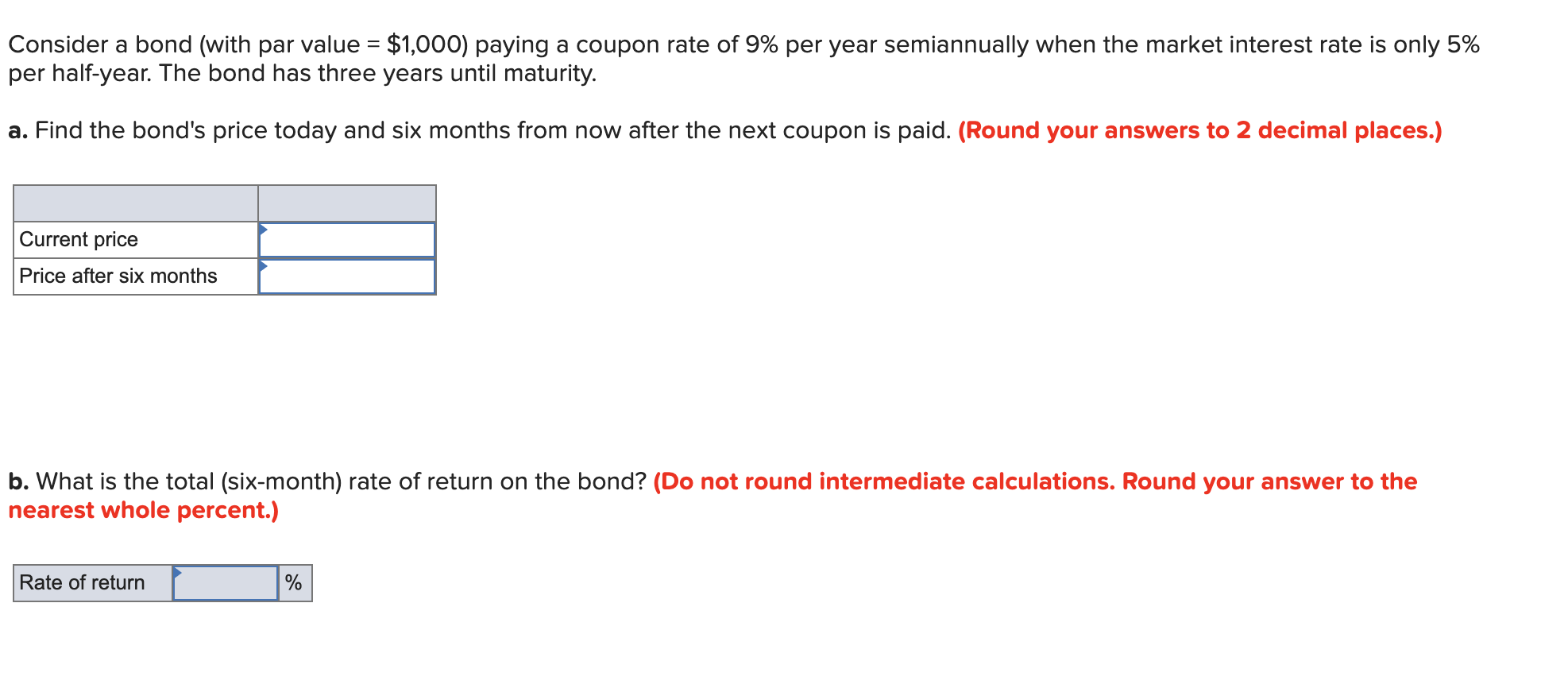

Difference between coupon rate and market rate. The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... Glossary - Common Fidelity Terms - Fidelity the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's secondary market fixed income offerings, … Coupon Rate Definition - Investopedia 28.5.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value What is the difference between coupon rate and market - Course Hero The discount rate is useful in determining the current value of money. Market rate of return is different from discount rate, (if the market rate of returns is equal to the value which is formulated from the results of the discount method), then the source is fairly traded. Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Business Finance - Interest Rates and Bond Valuation A. Coupon Interest Rate Fluctuations B. Mergers C. Market Interest Rate Fluctuations D. Loss of a Bond Certificate, What is a corporate bond's yield to maturity (YTM)? A. YTM is another term for the bond's coupon rate. B. YTM is the yield that will be earned if the bond is sold immediately in the market. C. What is yield to maturity? | Difference between YTM and coupon rate ... With financial literacy becoming more widespread, the bond market has become a good investment alternative. The returns received on bond investment are quite...

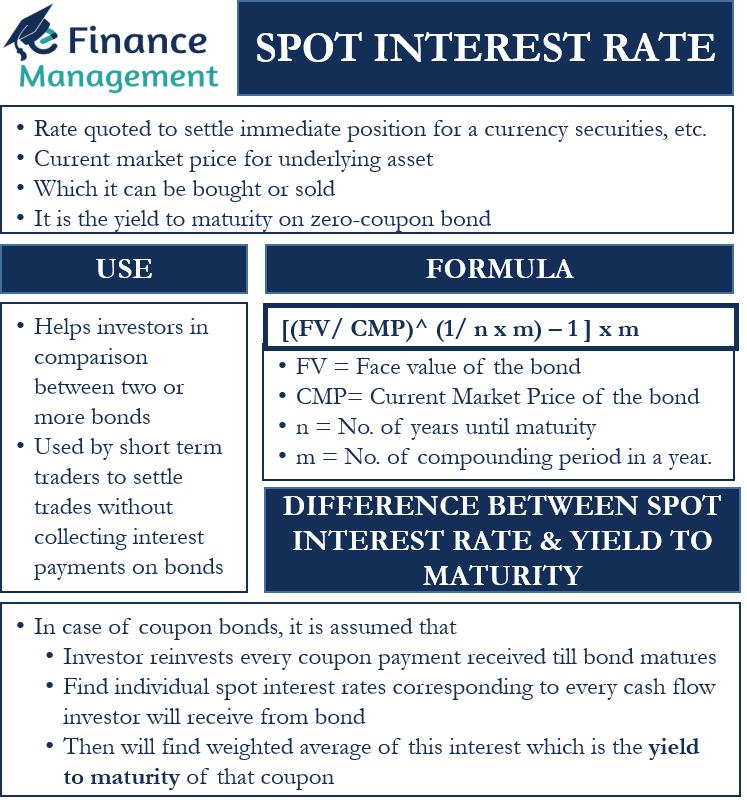

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

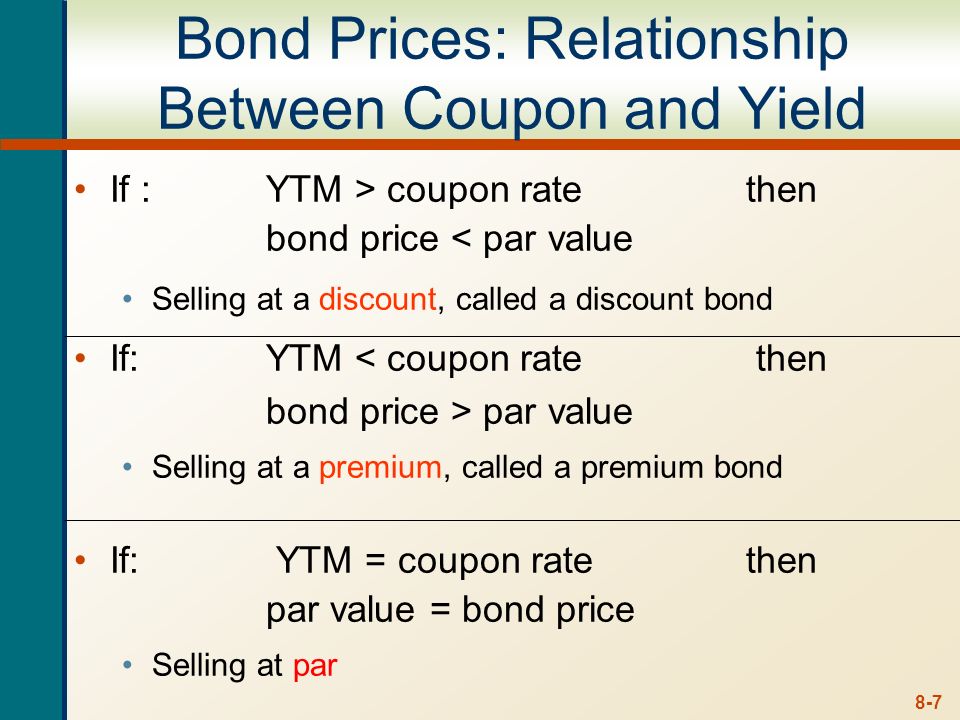

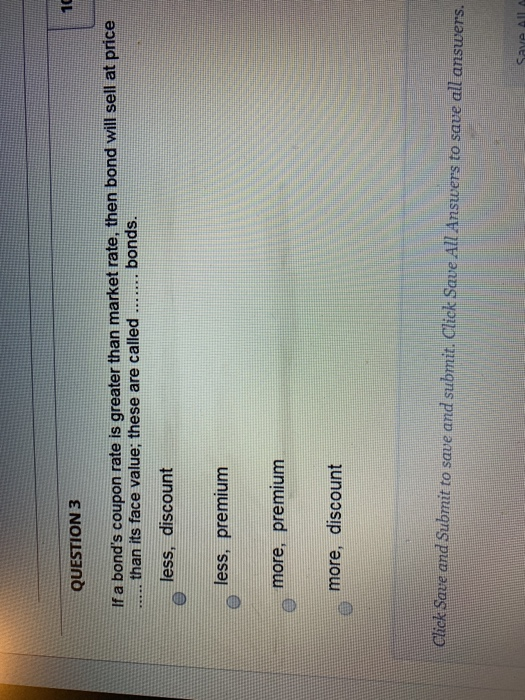

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond.

Difference Between Coupon Rate and Discount Rate the main difference between the coupon rate and the discount rate is that a coupon rate alludes to the rate which is determined on the face worth of the security, i.e., it is the yield on the proper pay security that is generally affected by the public authority set discount rates, and it is usually settled by the backer of the guards while …

en.wikipedia.org › wiki › Life_insuranceLife insurance - Wikipedia All UK insurers pay a special rate of corporation tax on the profits from their life book; this is deemed as meeting the lower rate (20% in 2005-06) of liability for policyholders. Therefore, a policyholder who is a higher-rate taxpayer (40% in 2005-06), or becomes one through the transaction, must pay tax on the gain at the difference between ...

Difference Between a Coupon Rate and a Yield Rate? The coupon rate is the annual interest payment made by a bond issuer, while the yield rate is the return an investor realizes on their investment. The coupon rate is fixed, while the yield rate can fluctuate based on market conditions.

What Is the Difference Between IRR and the Yield to Maturity? 27.3.2019 · Where C is the coupon interest payment, F is the face value of the bond, P is the market price of the bond, and "n" is the number of years to maturity. For example, let's say that we buy a bond ...

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · The CMA is focusing on three key areas: the console market, the game subscription market, and the cloud gaming market. The regulator’s report, which it delivered to Microsoft last month but only just made public, goes into detail about each one, and how games as large and influential as Call of Duty may give Microsoft an unfair advantage.

Difference between YTM and Coupon Rates A coupon rate, on the other hand, is simply the interest rate that is paid out on a bond annually. It does not take into account any capital gains or losses. In order to calculate YTM, one must know the bond's face value, coupon rate, current market price, and time until maturity.

Difference Between Coupon Rate and Interest Rate - diffzy.com The critical difference between coupon rate and interest rate is that interest rate is a fixed rate throughout the life of the investment, while the coupon rate changes from time to time, depending upon market conditions. The coupon rate is always estimated on the par value/ face value of the investment.

What is difference between coupon rate and interest rate? Answer (1 of 10): The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 bas...

What is the difference between Com and Co? (Nov 2022) The difference between .COM and .CO is subjective. Both domains hold importance depending on your business. If you need to compare on the grounds of popularity, then .COM extension is indeed very popular. Apart from being generic, it also offers commercial value to a website. Even today a new website prefers a .COM domain extension as compared ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market.

What's the difference between the cost of debt and a coupon rate? Answer: When a company sets out to issue debt in the capital markets, there are two primary factors that can make its cost of debt different from the coupon rate. First (and potentially smaller) is the cost of issuance - it has to pay someone to structure and market the bond (usually a broker-dea...

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Difference Between Coupon Rate vs Interest Rate What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price of the bond and is thus also known as the effective rate of return for a bond.

Finance exam 2 Flashcards | Quizlet Market interest rate fluctuations A corporate bond's yield to maturity: remains fixed over the life of the bond changes over time is usually not the same as a bond's coupon rate is alway equal to a bond's coupon rate changes over time is usually not the same as a bond's coupon rate

Difference between Yield Coupon Rate - Difference Betweenz The yield rate is the annual percentage of return on investment, while the coupon rate is simply the periodic interest payments (coupons) made on a bond or note. When you are looking at investments, it's important to know which one offers you a higher return. However, it's also important to consider other factors such as risk and liquidity.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this.

Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate.

Important Differences Between Coupon and Yield to Maturity - The Balance Prices and yields move in opposite directions. A little math can help you further understand this concept. Let's stick with the example from above. The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000).

Difference Between Coupon Rate and Discount Rate A coupon rate can be described as the annual rate of interest that the bond issuer pays to the bondholder on the fixed income security whereas a discount rate can be defined as the rate of interest chosen by the bank, paid to the lender by the borrower and is directly affected by the general economic conditions.

› ask › answersForward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The restaurant has an immediate business need and must pay the current market price in exchange for the goods to be delivered on time. ... The difference between the spot rate and forward rate is ...

Forward Rate vs. Spot Rate: What's the Difference? - Investopedia 30.6.2022 · Regardless of the prevailing spot rate at the time the forward rate meets maturity, the agreed-upon contract is executed at the forward rate. For example, on January 1st, the spot rate of a case ...

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ...

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA On the other hand, a Coupon rate is introduced where the risk profile of the borrower is high and the borrower needs re-finance or needs to go off from immediate cash outflow of its debt obligations which makes the company let go of the heavy principal payment which is due in the coming quarter or year Coupon Rate vs Interest Rate Comparison Table

Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · Find out why the difference between the coupon interest rate on a bond and prevailing market interest rates has a large impact on how bonds are priced.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia In general, a bond's coupon rate will be comparable with prevailing interest rates when it is first issued. A bond's yield, or coupon rate, is computed by dividing its coupon payment by its...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/interest-rates-1d0e17952d9949b1bab273e830855f90.png)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "40 difference between coupon rate and market rate"