41 coupon rate for treasury bonds

9 of the Best Bond ETFs to Buy Now | Investing | U.S. News Sep 09, 2022 · The action of the U.S. Federal Reserve in raising interest rates to combat soaring inflation brought an end to a 40-year bull market in bonds. Prior to 2022, decades of falling interest rates ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues. Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data. Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S....

Coupon rate for treasury bonds

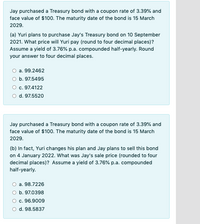

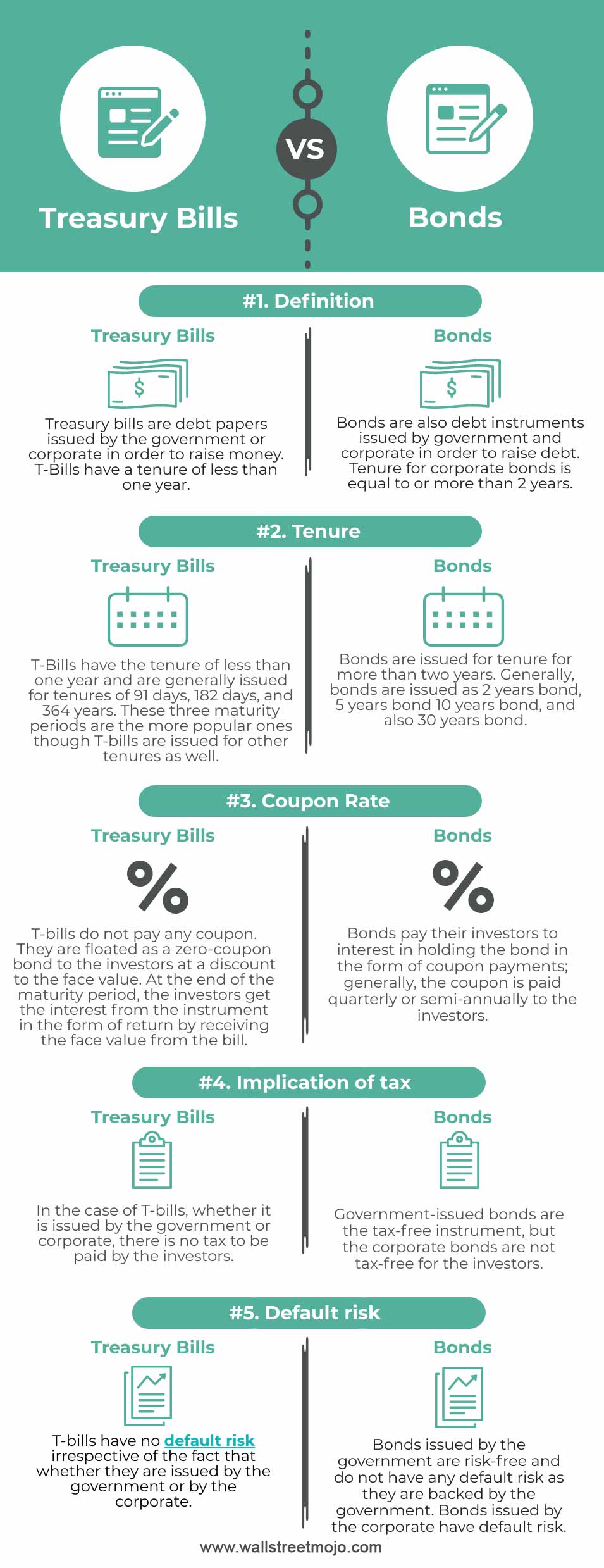

Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Bonds are issued for tenure for more than two years. Generally, bonds are issued as two years bonds, five years bonds ten, years bonds, and also 30 years bonds. Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. U.S. Bonds: Treasury yields rise to start the week The yield on the benchmark 10-year Treasury note advanced about six basis points to 4.214%. Yields and prices move in opposite directions. One basis point is equivalent to 0.01%.

Coupon rate for treasury bonds. Treasury Bonds: A Good Investment for Retirement? - Investopedia May 25, 2022 · Treasury notes or T-notes are very similar to Treasury bonds in that they pay a fixed rate of interest every six months until their maturity. However, Treasury notes have shorter maturity dates ... Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month . How Is the Interest Rate on a Treasury Bond Determined? - Investopedia T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the...

Treasury Bonds | CBK Oct 10, 2022 · Find your bond’s coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You’ll find a full schedule of your bond’s interest payments in its prospectus, which you can search for in our Treasury Bonds Prospectuses table above. Kindly note that this calculator uses a coupon-based rediscounting rate. Coupon Rate of a Bond - WallStreetMojo Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. Since the coupon (6%) is higher than the market interest (5%), the bond will be traded at a premium. Drivers of Coupon Rate of a Bond I bonds interest rates — TreasuryDirect The composite rate for I bonds issued from November 2022 through April 2023 is 6.89%. Here's how we got that rate: Interest rate changes depend on when we issued the bond Although we announce the new rates in May and November, the date when the rate changes for your bond is every 6 months from the issue date of your bond. Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves combined.

How the Treasury Market Predicts and Influence Interest Rates - The New ... By The New York Times. But Treasury yields began to climb well before the Fed started raising interest rates, signaling the bond market's expectations that the Fed was about to act. Yields on ... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face... Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ...

Continued Treasury Zero Coupon Spot Rates — TreasuryDirect 360. 3.63. 2.98. 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the Selected Asset and Liability Price Report under Spot (Zero Coupon) Rates on the following website: .

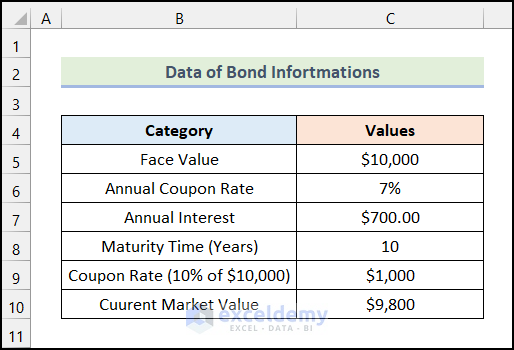

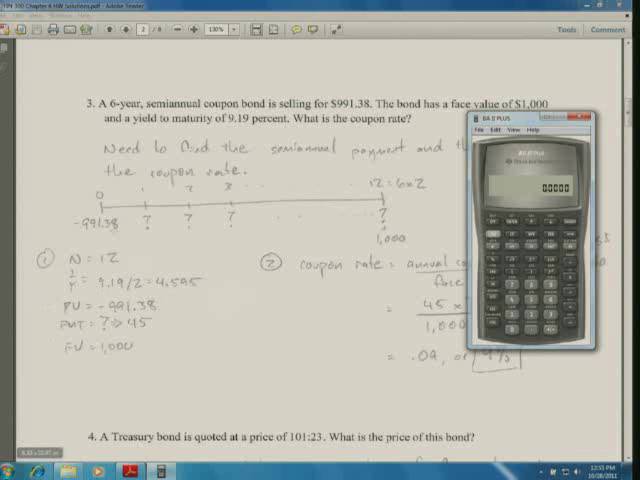

Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bond (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000).

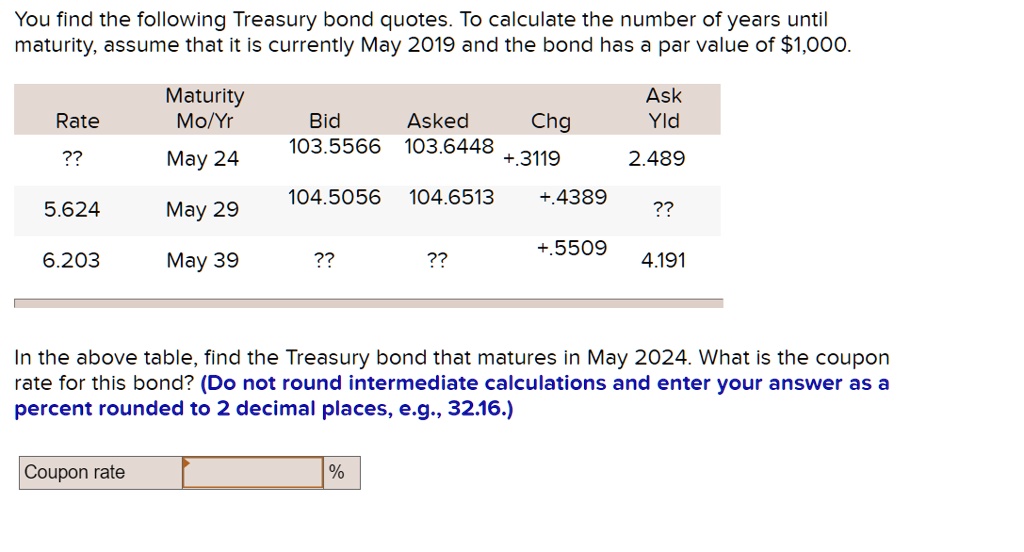

Who sets the coupon rate for treasury bonds? : r/bonds - reddit Here's my understanding from a fairly brief reading of the information on TreasuryDirect: The yield is determined at auction. For new issues, the coupon rate is set to the highest 1/8% interval below the yield and the price is at whatever discount makes the bond yield whatever the auction value was. For reopenings, the coupon rate was set by the initial auction and the yield from the auction is achieved entirely by adjusting the price.

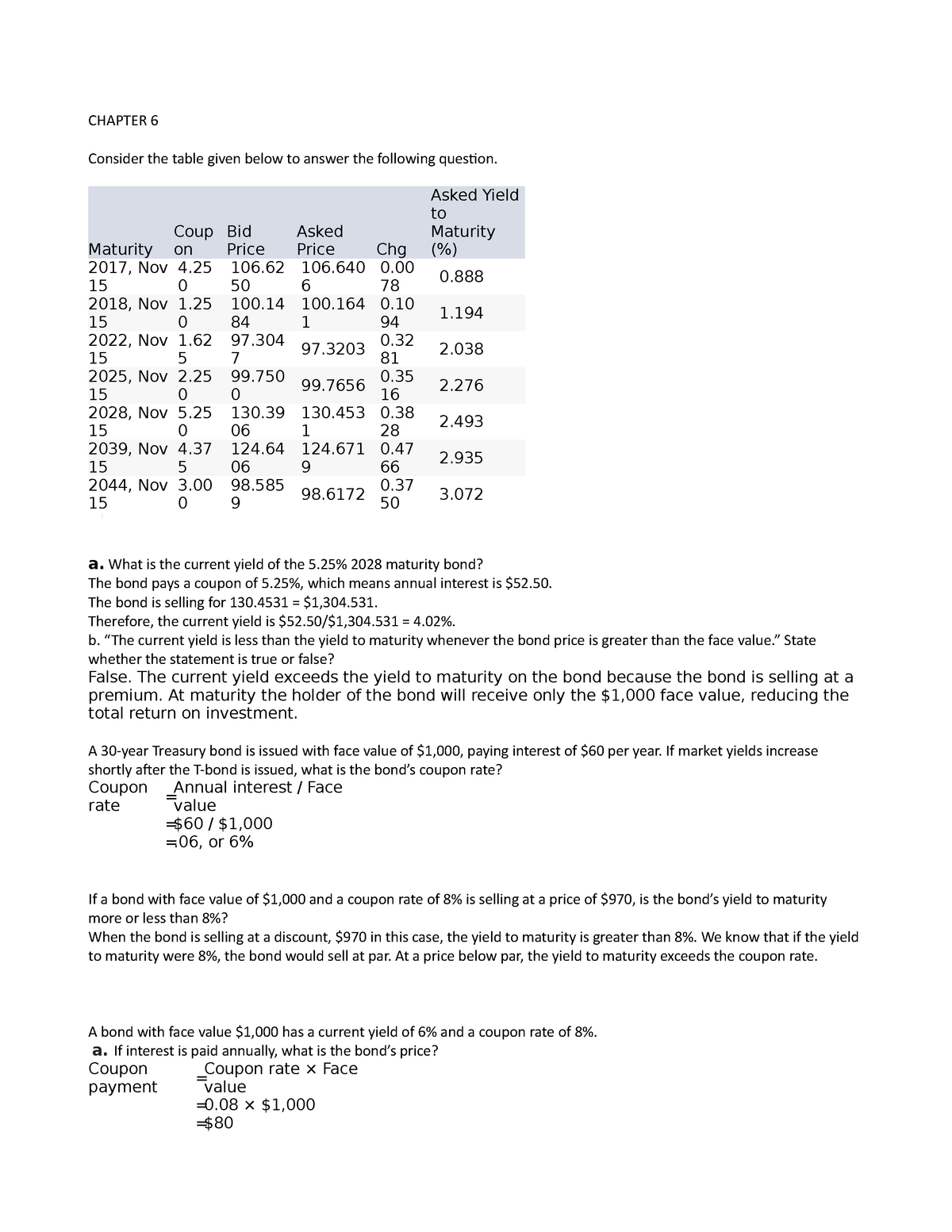

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Zero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Treasury Coupons - Macro Economic Trends and Risks - Motley Fool Community Animating the US Treasury yield curve rates. I ponder the limitations of animation, and how much work is needed to turn a fun animation into a great story. 1 Like. Leap1 November 10, 2022, 5:50pm #3. Mark, I found it on the treasury website. It is under the TNC, treasury nominal coupon rate, in table form.

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

U.S. Bonds: Treasury yields rise to start the week The yield on the benchmark 10-year Treasury note advanced about six basis points to 4.214%. Yields and prices move in opposite directions. One basis point is equivalent to 0.01%.

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Bonds are issued for tenure for more than two years. Generally, bonds are issued as two years bonds, five years bonds ten, years bonds, and also 30 years bonds. Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed ...

Post a Comment for "41 coupon rate for treasury bonds"